The Terrifying Truth About Sempra Energy’s Buyout of Texas Grid (Oncor)

As a homeowner, you depend on your utility company to provide reliable and affordable electricity. Texans no longer have control over their largest electrical grid after Sempra Energy bought Oncor for $9.45 billion. This is equivalent to about $29 per person in the US. Now, many Texans are left questioning the safety and cost-effectiveness of their power supply. Is there cause for concern? Sempra Energy’s acquisition of Oncor is a frightening reality, and we’re delving into the unnerving truth behind it. In this article, we strive to present a thorough examination of the agreement through incorporation of significant details and information, and with an imaginative flair.

The buyout of Oncor by Sempra Energy is not without its risks. Sempra’s acquisition brings new debt and equity that can hinder growth, and policy limits in Texas may hinder affordable service. As a company expands internationally, it must abide by foreign regulations which may lead to increased costs and decreased reliability for consumers.

The buyout of Oncor by Sempra Energy involve risks that may have a negative impact on electric power consumers. For instance, the acquisition has increased the company’s debt load and could negatively affect its financial position. Additionally, natural gas pipeline infrastructure and departing retail load resulting from the buyout could further exacerbate the situation. Sempra’s mounting debt could result in heightened borrowing expenses, having already caused unease among credit rating agencies. The acquisition may result in computer system failures, leading to unpredictable and lengthy outages. Customers won’t know when power will be restored. These risks could ultimately result in decreased reliability and higher costs for Texas electricity customers.

Disadvantages of Sempra Energy’s Buyout of Texas Grid

Furthermore, Sempra Energy’s buyout of Oncor has raised concerns with the Federal Energy Regulatory Commission (FERC). FERC oversees the US transmission and distribution system and fears that any changes could harm reliability. There are concerns that Sempra Energy may struggle to maintain Oncor’s high standards, which may increase costs for customers. Additionally, this buyout could result in increased power being sourced from large-scale, centralized sources instead of local, distributed sources. This could lead to more expensive electricity as well as decreased resilience if there are major power outages due to weather or other disasters. Ultimately, these risks could lead to higher costs for Texas electricity customers and a less reliable supply of power.

Disadvantage 1. Sempra Energy or Oncor buyout

California’s unstable power grid makes it difficult for the company, given its location in the state, to avoid power outages. Additionally, Californians pay some of the highest electricity rates in the country. Sempra’s track record in California hints at the possibility of Texans experiencing similar issues with their grid. Some other states where Sempra operates have faced problems with the reliability of their grids, leading to prolonged blackouts and unsafe living conditions.

The buyout of Oncor by Sempra has also posed risks related to domestic trade policies, capital structures and regulatory mechanism. For instance, the current U.S government regulations do not allow for the sale of natural gas from one state to another without approval from both states’ governments. This could lead to increase borrowing costs if Sempra plans to expand its operations in Sempra South American utilities. Sempra’s buyout may affect their ability to raise funds, borrow on favorable terms, and operate in foreign markets. New regulations, increased costs, and reliability may result.

Disadvantage 2. The buyout is the potential for increased electricity rates

Sempra has made it clear that the buyout is partly to help fund the expensive process of updating and maintaining the current Oncor grid. Homeowners, however, are worried that this could lead to increased electricity rates on their monthly bills. With little transparency on how Sempra Energy plans to handle this, it leaves Texans feeling uneasy about their future power bills.

The acquisition of Oncor by Sempra may affect capital markets, and trade disputes need resolution for successful construction projects. Sempra’s potential debt could lead to delays in infrastructure projects, causing reliability issues and higher energy bills for customers. Quick resolution of trade disputes is crucial to avoid further delays and increased costs from penalties and legal fees.

Disadvantage 3. Danger in security of Texas’ power grid

With Sempra Energy at the helm, the state’s grid is now in the hands of a foreign-owned company, leading to an increased risk of cyber-attacks and hacks. With high-tech cyberattacks on the rise, cybersecurity has become a top priority for home and business owners alike. Unfortunately, a foreign-owned company may be more prone to hacks as they may not have the same level of security as American companies.

Not only is the security of Texas’s power grid under threat, but so too are its residents. Outages due to equipment failures, explosions and terrorist attacks can negatively affect people’s safety, not just their electricity bills. Furthermore, the safety administration Los Angeles-based company, Sempra Energy, which owns Oncor, has an inadequate record with security issues. SDG&E Electric, a Sempra Energy subsidiary, was fined $25 million by the California Public Utilities Commission for negligent equipment and computer system management. Texas’ power grid has been blame for failing to meet safety and cybersecurity standards.

Disadvantage 4. The uncertainty surrounding the deal

While Sempra Energy claims that the buyout will benefit Texans in the long run, there is little transparency on how they plan to do so. Will the deal result in job loss or rate hikes? How will Texas’ grid infrastructure be updated and modernized? These are important questions that remain unanswered, causing homeowners throughout Texas to live in fear of the unknown.

Sempra’s acquisition of Oncor poses potential risks and uncertainties, including security, safety, cost, and revenue losses. Additionally, the increase in natural gas storage capacity may not meet the electricity demand during peak periods. The recent US tax reform has also caused confusion about investment taxation in energy infrastructure like transmission lines. This uncertainty may result in higher customer costs and adverse effects on power reliability.

FACT BASED

Sempra Energy’s increasing dependence on out-of-state power sources may reduce local power generation and environmental protection efforts. The global energy market is highly competitive, leading to possible discrepancies between estimated and actual results regarding Sempra’s Oncor acquisition. Furthermore, Sempra’s plans to develop liquefied natural gas terminals on the California coast raise concerns about potential economic, environmental, and air quality impacts, as well as local fisheries. These risks must be considered regarding the acquisition of Oncor.

The potential risks associated with Sempra Energy’s buyout of Oncor do not end there. Sempra Energy-owned facility violated hazardous materials regulations, leading to civil and criminal litigation. DOJ is also investigating business practices in Brazil. These could impact their ability to maintain Oncor and complete acquisition, with potential for fines and prosecution.

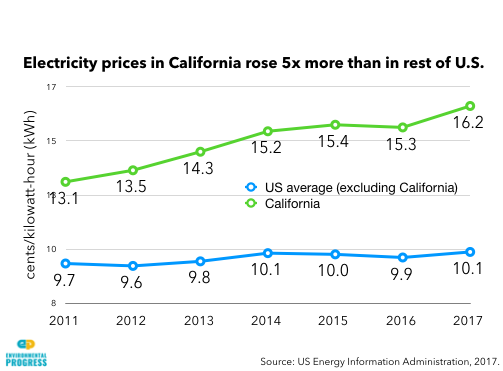

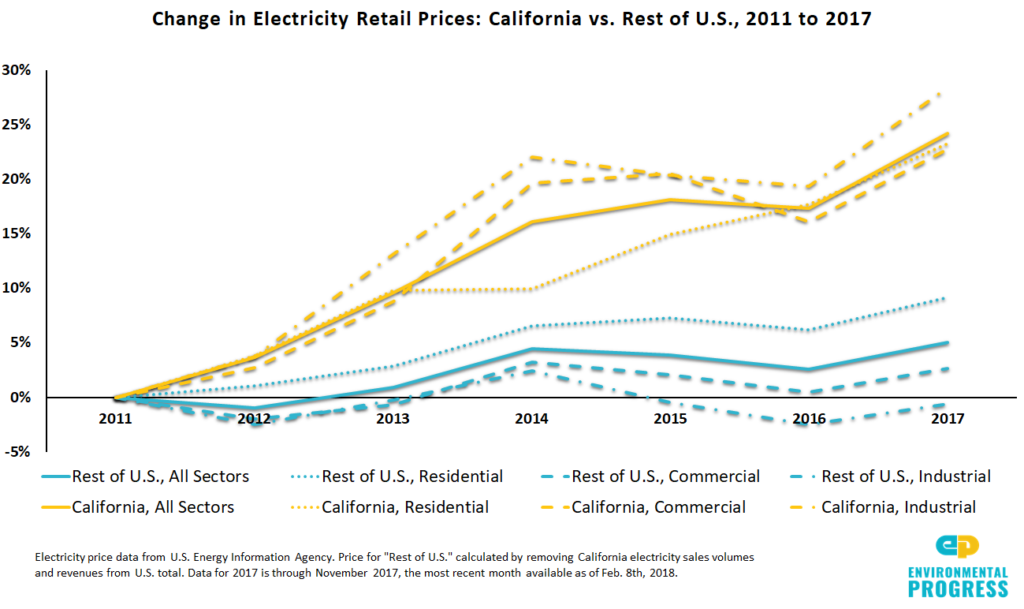

(Environmental Progress, 2018) – There’s no doubt from year 2011 to year 2017 there’s no stop in increasing Electricity Prices in California.

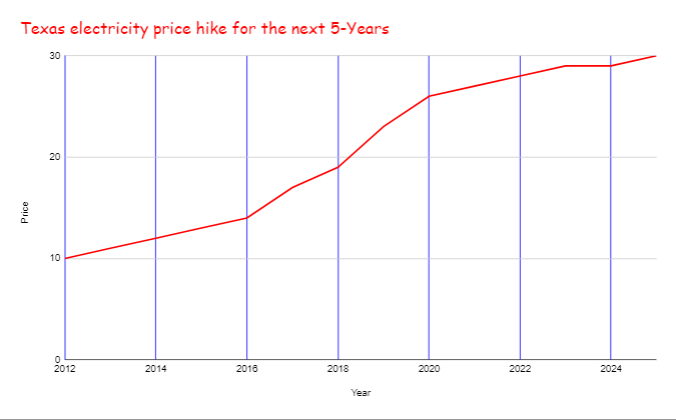

How Electricity Price Increase in TEXAS for the next 5-years

Sempra Energy’s buyout of Oncor is being scrutinized by the EPA and other regulatory agencies, particularly with regards to the grid’s environmental protection. Sempra may also need more permanent equity financing to venture beyond U.S borders, which would raise its debt load. This could lead to higher borrowing costs and a decrease in funds available for projects.Sempra’s construction or development activities may suffer delays and penalties for non-compliance with EPA, increasing costs and decreasing power reliability. It’s crucial that Sempra manages these environmental risks effectively.

Although Sempra Energy plans to add a minority member to its board and will likely face regulatory scrutiny, there are additional risks and uncertainties to consider. For instance, the need to renegotiate international trade agreements may arise, leading to higher costs or reduced reliability.

Basing This Images

How Electricity Prices in California Vs Rest of U.S rose for the last 5-years

Sempra Energy is striving to expand into worldwide markets such as Oncor, Energy Future Holdings Corp, and Southern California Gas Company as part of its strategy to increase profits by investing in the energy sector. However, there are risks related to political weakness and regulatory compliance. Trade disputes between the US and Sempra’s international markets may cause financial loss, and investors may be afraid to invest in a foreign-run company perceived to have increased risk. Ultimately, this could limit the company’s ability to secure necessary capital investments needed to ensure long-term success.

https://images.squarespace-cdn.com/content/v1/56a45d683b0be33df885def6/1518468811262-0XS7MZTAMZE80CQ2S680/Screen+Shot+2018-02-12+at+12.53.06+PM.png?format=750w

As Sempra Energy seeks to meet future capital expenditures due to their acquisition of Oncor, their regulatory capital structure could possibly undergo a shift. Sempra may need to consider using equity or convertible debt to finance their expansions and projects. Sempra may face difficulty achieving its global clean energy objective as it embraces renewable sources, hampering its borrowing capacity for future investments. Consequently, Sempra’s scope may be restricted, impacting their ability to achieve their mission. Therefore, it is crucial to manage regulatory changes and expand cleaner energy production worldwide for success.

Homeowners are apprehensive about Sempra Energy’s acquisition of Oncor, fearing unpredictable electricity costs and potential power outages. Although there may be some advantages to the deal, uncertainties and various concerns have left property owners feeling unsettled. In addition, the hazards involved are too significant to overlook. Consequently, it is vital to gain more information before making any decisions. Texans must urge Sempra Energy to be transparent and accountable for safe, affordable energy in the future. It’s imperative for their wellbeing.

The best solution is to GO SOLAR !

Go Solar with Trusted Industry Experts and Contact us here