Investment Tax Credit: Excellent Way to Save Money

Claiming the ITC is an excellent way to save money on the cost of your solar energy system. The ITC allows you to deduct 30% of the cost of your solar panel installation from your federal taxes. This tax credit is available to both residential and commercial solar installations, and there is no cap on the amount of the credit you can claim.

How to Save Big with the ITC Tax Credit for Your Solar Energy System

Solar energy has become a popular and affordable option for homeowners who want to save on energy costs while helping the environment. However, the initial cost of a solar installation can be a deterrent for many. By making use of the ITC tax credit, significant savings can be achieved by homeowners looking to install solar systems. This provides an exceptional chance to switch over to renewable energy, resulting in affordability and accessibility. Factors such as location, system size, and installation date can influence the percentage of savings.

With an applicable federal tax credit, solar energy systems can be bought and installed for both residential and commercial purposes. Thirty percent of the total installation cost can be deducted from homeowners’ tax returns. This discount is known as the ITC tax credit. For instance, if your solar energy system costs $20,000, you can claim a $6,000 tax credit.

Moreover, the ITC allows you to carry over any unused tax credit to the next year. Even if the entire tax credit isn’t used in the current year, it can be claimed in subsequent taxes. This provision benefits homeowners who’ve recently installed solar panels, as they can take advantage of the ITC tax credit during their first year of ownership. With this benefit, homeowners can save more money while also contributing to a cleaner environment.

It’s also worth noting that the ITC tax credit is available until 2022 but will slowly reduce each year. Homeowners must complete installation and service for their solar system within the same year that they claim the credit. Additionally, the ITC applies to solar systems that are purchased, installed and operational before 2019 to get the full 30% credit.

With the ITC tax credit for solar installation set to expire in 2022, now is the time for homeowners to act and reap the benefits of this environmentally friendly initiative. The credit gradually decreases over time, making the urgency to transition to solar energy imperative. Don’t let this opportunity slip away, take action today to boost savings and help protect the planet for generations to come.

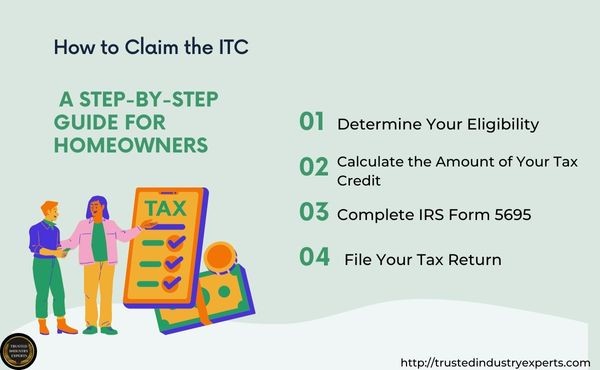

How to Claim the ITC: A Step-by-Step Guide for Homeowners

As a homeowner, saving money is always a top priority. Whether it’s for a down payment on your next home or an emergency fund, finding ways to save money is essential. One way you can save money is by claiming the Investment Tax Credit (ITC). This tax credit can help you save thousands of dollars on the cost of installing solar panels in your home. And, to help you claim the ITC, we have created a step-by-step guide that covers everything you need to know about the process.

To help you claim the ITC, we have created a step-by-step guide that covers everything you need to know about the process.

Step 1: Determine Your Eligibility

Before you can claim the ITC, you must determine if you are eligible for the tax credit. To be eligible, you must meet the following criteria:

- You must have installed solar panels on your primary residence or a property you own.

- The solar panels must be new and not previously used.

- The solar panels must be in use in the same year you claim the tax credit and payment.

Most investors want to have savings account and are looking for the best way to do it. Taking advantages of the ITC tax credit is an excellent way to save on the cost of a solar energy system installation.

By reducing their federal taxes, they can reduce their interest rates and risk tolerance while still achieving their savings goals.

In addition to taking advantages of the ITC, cutting spending on other items can also help to have saving at a federal level. With careful planning and understanding of the benefits of the ITC, most investors should be able to take full advantages of this tax credit and save big in the long run.

Get Creative with Your Savings: How Cutting Spending and Using the ITC Can Benefit Homeowners

If you’re a homeowner, you know that saving money on your taxes can make a huge difference in your overall financial picture. The Investment Tax Credit (ITC) is one way to do this, but there are other ways as well. Cutting back on other expenses can help you free up money to invest in your home and take full advantage of the ITC.

In this blog post, we’ll discuss how you can harness the power of the ITC while also cutting expenses in other areas of your life. By doing so, you can maximize your savings and invest in the long-term health of your home.

1. Start with a budget:

The key to cutting expenses is knowing where your money is going. Start with a budget that includes all of your monthly expenses, from mortgage payments to utilities to groceries. Identify areas where you can cut back, such as eating out less or cancelling subscriptions to services you don’t use. By reducing your daily expenditures, you can free up more money to invest in your home and take advantage of the ITC.

2. Make energy-efficient upgrades:

One of the best ways to use the ITC is to invest in renewable energy sources. Solar panels, for example, can save you a significant amount of money on your energy bills each month, while also providing a tax credit to help offset the initial cost. By making energy-efficient upgrades, you can lower your overall expenses and reduce your carbon footprint.

3. Look for deals and incentives:

Many retailers and service providers offer deals and incentives to homeowners who make energy-efficient upgrades. Look for promotions on appliances, lighting, and other products that can help you reduce your energy consumption. Additionally, check with your local government to see if there are any other rebates or tax incentives available for energy-efficient home improvements.

4. Use the ITC to your advantage:

The ITC provides a 26 percent tax credit for homeowners who install solar panels or other renewable energy systems. This credit can be used to offset the initial cost of the system, making it more affordable for homeowners. Additionally, the ITC can be used in combination with other federal and state tax credits and incentives to further reduce your expenses. By taking full advantage of the ITC, you can save big on your taxes while also investing in your home.

5. Keep an eye on your savings:

As you implement these strategies, be sure to track your savings over time. This will help you see the impact of the ITC and other cost-saving measures on your overall expenses. By making adjustments along the way, you can continue to maximize your savings and invest in the long-term health of your home.

The ITC is a powerful tool for homeowners who want to save money on their taxes while also improving the sustainability of their homes. By combining the ITC with other cost-saving measures, such as reducing daily expenses and making energy-efficient upgrades, you can maximize your savings and invest in the long-term health of your home. With careful planning and a commitment to reducing your expenses, you can achieve your financial goals and enjoy the benefits of a sustainable, energy-efficient home.

Step 2: Calculate the Amount of Your Tax Credit

To calculate the amount of your tax credit, you will need to determine the cost of your solar energy system. This includes the cost of the solar panels, installation, and any associated equipment.

There are several other ways to have saving in addition to claiming the ITC tax credit. For instance, you can minimize your taxes by contributing to a retirement account or investing in mutual funds.

Additionally, medical expenses and health insurance premiums can be deducted from your tax bill, as can certain living expenses such as mortgage interest payments or home improvements. By taking advantages of these deductions, you can significantly reduce your taxable income and saves money on your taxes.

To calculate the amount of your tax credit, multiply the cost of your solar energy system by 30%. For example, if your solar energy system cost $20,000, your tax credit would be $5,200 (30% of $20,000).

Step 3: Complete IRS Form 5695

To claim the ITC, you must complete IRS Form 5695, “Residential Energy Credits.” This form is used to calculate the amount of your pay taxes and must be included with your tax return.

In addition to the ITC and investment accounts, there are other ways to save more money. Local governments often offer tax credits, tax advantaged accounts and incentives for homeowners who install solar energy systems in their homes. For those interested in tax efficient investing, stocks can be a great way to grow your wealth over time.

Investing in stocks is also beneficial when it comes to reducing your total income on your investment and checking account, as any gains you make will not be taxable account until you cash out the tax advantaged account. Additionally, looking into different cell phone plans and shopping around for the best deals will help you reduce your monthly expenses and put extra money back into your pocket.

For those who are serious about saving more money, setting savings goals is important. This helps ensure that any extra cash on your investment accounts you have is allocated towards achieving financial goals like buying a home or starting an emergency fund. Savings goals also help motivate people to save more consistently and actively work towards making their dreams a reality. Taking advantage of tax bill like the ITC, evaluating different cell phone plans, and investing in stocks are all excellent ways to savings goal and build wealth over time.

On Form 5695, you will need to provide information about your solar energy system, including the cost of the system, the date it was placed in service, and the amount of your tax credit.

Step 4: File Your Tax Return

Once you have completed Form 5695, you can file your tax return with the IRS. Make sure to include Form 5695 with your tax return to claim the ITC.

Claiming the ITC is a great way to savings goal on the cost of your solar energy system. By following our step-by-step guide, you can claim the tax credit and start enjoying the tax benefits of solar energy.

In addition to claiming the ITC tax credit, there are other ways older adults in saving. Contributing to a retirement account or investing in mutual funds is a great way to reduce taxes and increase savings. USA Today recommends setting up an emergency fund for unexpected expenses in case of financial hardship. This allows retirees to access cash quickly without having to dip into their retirement and health savings accounts.

Another option for saving money is to pay down any high-interest debt. Reducing debt can also be beneficial for reducing taxable income and maximizing savings. Receiving expert advice on how to best manage one’s finances can help older adults make the most of their resources so they can save more effectively.

With careful planning, budgeting and taking advantage of tax credits like the ITC, older adults can do saving while still enjoying their retirement years comfortably.

We hope that this guide has been helpful in understanding the process of claiming the federal Investments Tax Credit. If you have any questions or need further assistance, please don’t hesitate to contact us.

Go solar with Trusted Industry Experts and Contact us here

#solarenergy #solarpanels #investmenttaxcredit #ITC #energyefficienthome #savemoney #greenenergy #sustainability #homeimprovement #taxcredits #federalandstatetaxincentives #retirementaccounts #mutualfunds #savinggoals